Writing down some notes of what I’ve seen in the market for the last two years.

I’m not quite sure where the market is going, it looks pretty fatigued. When I came back to trading/investing in crypto in summer 2020, I was under the assumption that this cycle would probably end around us topping at 5 trillion dollars. This article is perhaps just a recollection and retrospection with some learnings of what I saw since then with some Dota analogies (bear with me through those).

Note: Someone told me that this work reminds them of Cobie ser’s, Trading the Metagame, So you can probably skip this if you have read that, This is probably just an extensive exploration of that idea dating back to defi summer 2020.

I’m a DOTA 2 player (Defense of the Ancients), and it’s viciously addictive having spent 3000 hours playing the game and even then still being engaged by it, I often wonder what makes me go back to the game? Most modern RPGs are played around for 100 hours to complete the main storyline while 200-300 hours for covering everything. DOTA 2 is an MMORPG (pronounced morph) and something that keeps getting changed due to patches, the heroes are balanced/the map is changed/the items are updated, and that keeps it very interesting.

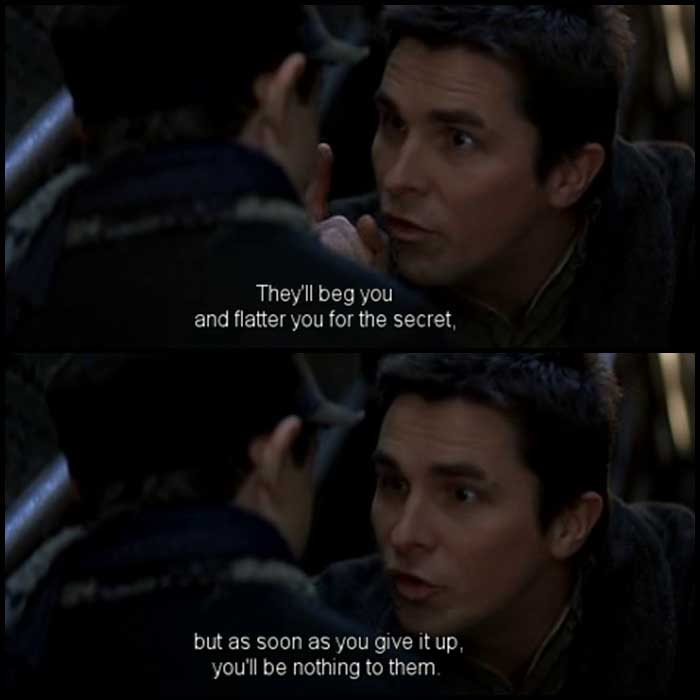

There is this dialogue in the movie, The Prestige by Alfred Borden,

And while that is true about magic tricks, that is true about games as well, “figured out” games simply aren’t interesting, and every patch in dota brings with it new things to figure and new interactions to explore and new things to learn. There’s probably something about stochastic games, partially observable games which keep humans engaged (since we are pattern recognition machines constantly trying to figure stuff out).

So what happens when a patch is figured out, what does it look like in a game, Some heroes are found to be more broken than others they are simply better given of the in-game economy and the items available (in their current form in this current state of the patch). And this is when a meta develops.

The meta is almost always created by the players. They try several builds and items and some strategies eventually tend to work much better than the other ones. Even with relatively “balanced” patches, some things become more popular than others, even though there might be other broken things (due to influential people, pro players in the context of a game). Developers then nerf certain things that are too broken and another cycle of finding the next meta commences, also done so that the game doesn’t become too stale. That probably is enough of a digression from the point of this article. But the existence of a big action space, by that I mean, there are too many things to try out always means that even though there might be some things popular in a meta, given that the popular stuff gets nerfed, there might still be things in the system that can be exploited or found to have an edge over others.

But what does the meta of a video game have to do with crypto? Abstract models translate to other places in the wild too. Crypto being the hyper-financialized paradigm of tokens and projects that it is, is very much like the partially observable, stochastic games that are played in dota, league of legends or other MMORPGs. The meta is the tokens that are currently going wild, the projects that have the maximum attention devoted to them because financial regimes seem to be driven by intrinsic attention economies. The thing about attention economies is nothing can stay in its place forever and the meta dissolves (in this case this certain class of projects die) and then either it’s on to another class of projects or everything is just silent for a while. Why is knowing any of this important to you? Knowing about the existence of the metagame perhaps helps you discover them or recognize the one you are in or discovering some common trends in the different metas could help you know if the shitcoin that you currently have has something unique in it to drive its own meta. After all, you play to win.

While when the run in summer 2020 began, crypto was but a 250 billion dollars worth asset class and I was initially even sceptical of it ever reaching the trillion-dollar mark (because that for me was the hallmark of a mature asset class) the highest it ever went in the 2017 run was 850B before collapsing to 150 billion at its lowest. It has 10xed in 2 years achieving an all-time high of around 2.5 trillion dollars and currently sits at 1.7 trillion. But I think regardless of that what is quite true (and might stay true unless we go sub trillion as a market), An asset class worth a few trillion dollars is liquid enough to fund its own microcycles and anyone who understands this is positioning themselves for some gains (if not a lot).

Token Metas

I will first cycle through token projects, and then later talk a little bit about NFT cycles (there haven’t been many). Also, some of the chronology might be misplaced or just simply wrong but I’ve tried to recapture the major ones that I recall.

Nothing taught me about information asymmetry, which could be something as simple as knowing to use a product or putting different things, as much as defi summer 2020. The early projects were yam, yearn, harvest and other projects which at this point were called defi even though all they had was TVL based token emission slowly getting diluted through pool 2s and had insane APYs which hovered from 6 digits to 10 digits. Anything less than 5 wasn’t even considered. Most people were still trying to figure out the process of depositing tokens → getting LP → depositing LP share → claim rewards, which wasn’t clear early on or were too scared because the APY looked too good to be true. I think a dominant signature of different metas in crypto and I will mention this latter too, is that you can identify the ending stages i.e the meta attaining critical mass by the number of rampant forks that it spawns. Kimchi, Based Finance and other names I can’t even recall were forks attaining 9 figs worth TVL less than a day into the launch and losing it just as quick.

Simultaneously around the end of the yam cycle which ended with a smart contract bug (which would’ve or did, I don’t recall, led/lead to loss of funds), developed the rebase token project meta. You could recognize this by the number of people talking about how the “elastic supply” of tokens led to better tokenomics. Everyone suddenly knew what elastic supply meant and what number $AMPL or some random rebase token would have to be at to rebase positively or negatively. Something that is very true, particularly about financial games is that (only?) being early helps and that the later you are to the game, the more likely you are getting dumped on, so if you recognize that you are late to this meta you are probably better off avoiding it, because you probably don’t know what stage you are in and could probably end up losing a lot if you are late.

In the shitcoin projects that I saw something that became popular for a while after this was deflationary tokens which rebased, every transfer had a penalty but holding the token availed you rebases and unlike the earlier rebase tokens these were strictly positive rebases. This did not last for very long since it led to quick inflation of the supply and the bigger participants profited very quickly and moved to book their profits.

Soon after the rebase coins, late 2020 saw the rise of algorithmic stable coins. This was the introduction of game theory (somewhat so) to tokenomic design and has been tried in a variety of ways since, but early on was about how long the stability of the ecosystem could be kept propped up through bond sales and the emission of the stable coins to bring the value of the coin closer to 1$. Empty Set Dollar (ESD), Digital Set Dollar(DSD) are just a few names that come to my mind when thinking of these, both of them trade at a cent or so today, so while it was an interesting experiment per se, it’s clear that they didn’t survive.

Q1 2021 was a period during which almost every token was going up only, and you didn’t have to exactly be right about the meta to make money in this period. Tokens were up 10-20xes in 30-45 days and the saying “you don’t have to be right in a bull market” comes to my mind quickly. Around early q2, dog coins and other meme-able name coins (like cummies, safe moon etc) started getting more popular and while you could call this a meta or an overheating market (since you would see no value in these tokens), its true that this part was one of the most degen parts of the cycle.

While late Q2- early Q3 2022, were somewhat muted something that came after this was the L1 cycle. Where all L1s were suddenly pumping, you could say that this was a confluence of several things and while it would be untrue to say that these alternative L1s didn’t work before then, it’s coincidental that everything came together for this to happen. A popular tweet by the fox would probably sum up Q3 2022,

Something curious about L1 cycles was that they were first token pumps and then ecosystem pumps, where the value of the token went up and then the projects on-chain went up (somewhat consecutively instead of in sync), and these in-ecosystem pumps had their own micro cycles which lasted from days to weeks. This also went onto other L1s not just the ones listed above, but the fact that those projects now inhabit the top 20 in the space speaks about their success more than others.

Late Q3, saw the rise of Olympusdao. A POL service that was launched in March 2021, which took some time to actually get stable, was countercyclical for the entire dip in Q2-Q3 because of the coin being solely backed by USD reserves. The thing that really made Olympus popular was the narrative that surrounded it and (3,3) which will probably be remembered as one of the hallmark memes/narratives to come out of this cycle. Something that quickly became obvious alongside the rise of Ohm was that in a multi-chain world, the meta would also become multi-chain and forks wouldn’t be restricted to the same chain. The rise of Time, Rome, Snowbank, Spartacus, Invictus are proof of this and something to keep in mind for the future, something that was fascinating to me about multi-chain forks was the fact that it did not fractionalize liquidity from the main project. Will seamless multichain interop change this? Only time will tell.

For a moment or two in late 2021, early 2022, projects with ve-conomics especially those that involved themselves in the curve wars started pumping. It did not last long enough for me to credit it and call it a “meta”. But something that has definitely been true for me over the last two years has been the following

If crypto is a game, tokenomics is the meta - @cobie

Most crypto micro-cycles have been driven by the tokenomics of the project, which get exploited for maximal gains and quickly fall down as well. Do projects in these metas contribute something to the long term health of the ecosystem? As I write this article, ohm forks (which were the last meta) are down 90-95% since their market top but it’s undeniable that they pioneered the liquidity as a service idea and continue to through Olympus pro. Also, the game-theoretic algorithmic stablecoins were an important experiment which probably couldn’t have been done were it not for the existence of crypto, and finally, something true about all these microcycles is that narratives and communities in projects matter.

Most innovation in defi seems to revolve around making the tokenomics more appealing to the holders, and while that may be an interesting problem to solve. It won’t increase the surface area of participation that we all aim or hope to see.

NFT Metas

If NFTs are a game, style is the meta.

NFTs are relatively a much more nascent market compared to token projects but may at least provide some solace to the holder because they can perhaps say that they were in it for the art (if the art is good). I will keep this part short.

While crypto punks were extremely popular they never quite garnered heavy attention until late 2021. One of the first NFT micro-cycles was developed elsewhere in the project called Hashmasks. Hashmasks started the bonding curve meta, not quite bonding curve as much as selling blocks of the supply in increasing order until the supply was over (which was tried for at least 4 months by a variety of projects). Something that was quickly evident with NFT projects was that community engagement matters. Hashmasks were the heartthrob of crypto Twitter, while everyone figured out hidden meanings in the artwork, a variety of servers spawned which catered to different trends within the artwork. Hashmasks also was one of the first projects to have more volume in sales than crypto punks in a given day. Hashmasks today does less than double digits volume in a day (if any at all).

NFTs were quick to die in the event of the May 2021 meltdown.

Since then, in late q2, NFTs saw the PFP meta which was led by cryptopunks and then extended to byac, doodles, cool cats and various other PFP projects.

Something that was very popular and in retrospection definitely just a meta within the NFT space was the generative art NFT series. Q3 2021 saw the rise of a variety of sub art projects from Artblocks. Fidenzas, Singularities, Subscapes, Archetypes were just a few names that I can recall from the 15 or projects that were existent then which commanded high valuation up to as much as a few thousand eth for a Fidenza sale. Generative art was hailed because of a variety of things, and you can only question the veracity of those claims now that they seem to have had a similar fate to that of hashmasks. Why did generative art fail? I don’t think it was as much as generative art that failed, as much as it was the reason of the interest in these projects. The projects are not any less aesthetic today than they were at the top. A primary reason of interest for Artblocks was the collections had about 1024 supply and artificial scarcity (low supply is good) remains one of the best ways of pumping the value of an NFT supply. Artblocks kept releasing about 3 new art series every week since q3 2021 and you could say that ironically supply fungibility was why the gen-art meta came to an end.

Something that started crowning its head at the end of the gen-art cycle were the Loot projects which in its most idealistic sense could be thought of as seeds for games in the future/ or art in the case of the n-project. Loot was hailed for a variety of reasons and perhaps development for the game still happens today ( i am unaware, although i did see a project launch visualization for loot recently). Loot also saw the rise of the NFT-token meta where every loot holder was airdropped tokens (AGLD) which would be used in the game economy. This idea has since then been adopted to a variety of projects, and every NFT project plans to launch a token for its supply or is at least actively considering it. Something to wonder about when it comes to this is if it’s a good idea to 1] fractionalize liquidity from the NFT volume to fund a liquid token? 2] Are liquid tokens necessary for something NFTs? And while these questions might have been ill-formed I hope you get the idea.

As of the time of this writing, we recently just saw the anime-pfp microcycle, which didn’t last as long as I expected it to. but NFTs have definitely seemed to have had their own economy insulated from that of the wider crypto market perhaps due to their mainstream appeal.

I might have missed mentioning a variety of projects or cycles in my article but I hope i have mentioned enough for you to understand the broad strokes of this cyclical market that we thrive in. One thing that I definitely missed from the top of my head is the trading card NFT cycles and classifying projects like Aurory, magic and others to the metas that I have mentioned.

A small crossover that was seen and has since then developed and will probably keep getting more common until it blurs all the lines is the Play to earn ecosystem. The market resurrection in q2 2021, was led by Axie Infinity, a play to earn NFT game where you had to buy the Axies to play the game and were rewarded. A lot of projects have since then tried to pioneer Play to earn and have been successful to various measures, but to date, no game seems to have had the same success that you would find from a game from a traditional gaming studio. There was also a micro P2E cycle which was sparked by $jewel, a token for the economy of the P2E game, DefiKingdoms. Something that was fascinating about DFK was the fact that it had bought all aspects of crypto into the game, was an intersection of various concepts and was perhaps one of the only projects which led the underlying L1 to be used more than it previously was.

I wrote this article to keep reminding myself of the following

That recognizing that the market funds micro-cycles allows you to keep playing the game even when the wider market might be consolidating but also recognizing meanwhile that fatigued markets do take breaks and these microcycles only get rarer in these markets (this is when you start planning to take a break).

It’s frustratingly simple to convince yourself that you could have seen all the signs of the meta developing had you done something differently because it is in retrospection. You can keep reminding yourself of the signs that you saw in the previous microcycles and keep applying them to find new ones, but something that has to be kept in mind is that Metas don’t always develop quite the same ways, some achieve critical mass very quickly (like algorithmic stable coins) while others have to survive and the narratives around it have to develop for them to achieve it. Knowing what will happen with the shitcoin you are invested in is almost next to impossible, and perhaps that is why I end with a note to myself, “don’t get married to your bags.”

Something that is no longer true as it once was is the ability to keep in touch with everything in the market today. I could name almost 90% of the hot projects in early defi summer, actually, almost all of them save a few. Today I barely know a few real projects forget hot ones. It’s hard to keep track of a space that has about 13k projects (consider even the first 1500 for brevity). But as Jeff Bezos once said, “Your margin is my opportunity”, something that is true for someone new entering the space is that “your lack of attention in my opportunity” (quite doesn’t roll off the tongue as well). The game gets harder when there are more participants because newer cycles might not even get the time to fully develop before they are dominated or found out by the market. Information asymmetry keeps growing and the meta gets hidden from public spaces eventually becoming non-existent to the public.

Its been an interesting mental exercise to consolidate these ideas and I hope they’ve been of some interest to you as well.